On average, normal mortgage can last from 15 to 30 years. A lot of the repayments made these mortgages go for the interest of mortgage loan. It will only be after a number of years before the repayments actually affect the key amount of the borrowed funds. If you're looking for a quicker way in order to your mortgage, a great way to do it must be to make additional payments every month. An additional $100 can help in terms of taking months off your mortgage interval. Using a mortgage calculator, you can master how your extra payments can slash years off your financing.

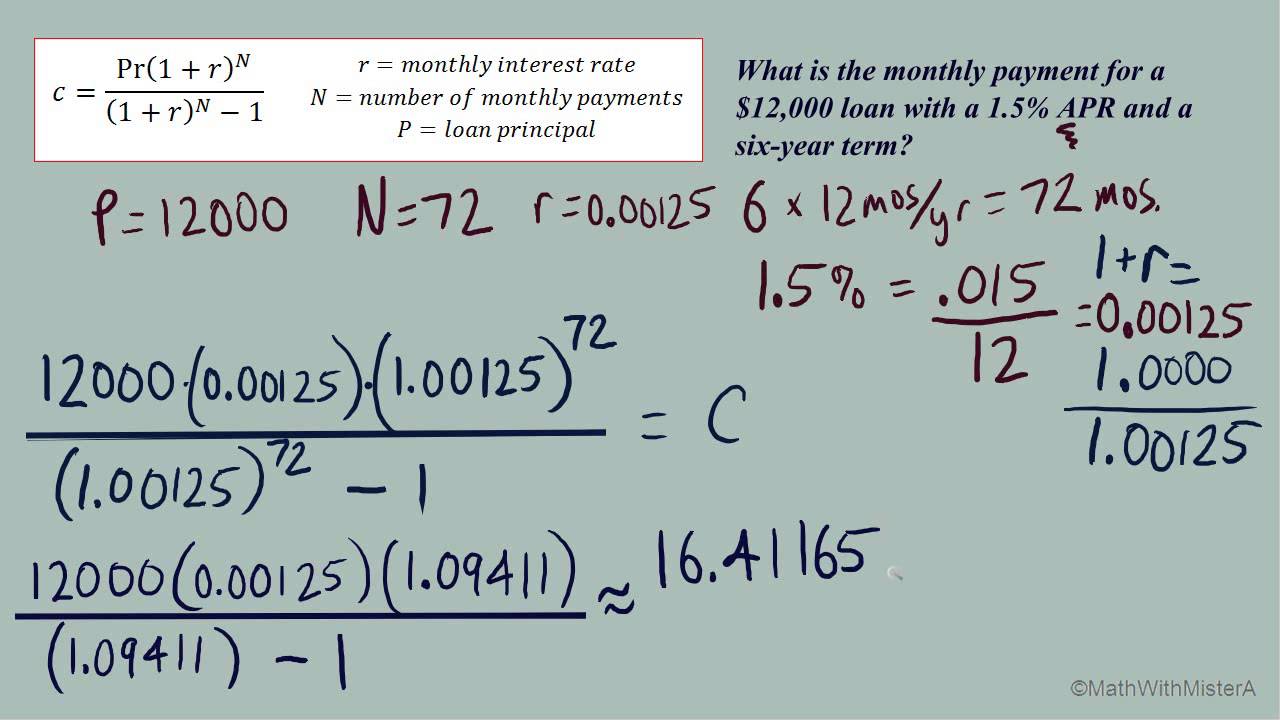

There possess a higher of businesses that designs application. Most of the companies are focused on a specific segment of the. Some application development companies focus on games, offers the biggest market share of all of the applications. focus on the applications that can help you employing your daily life. For example, calculators are a common scene applications a person come all over. These calculators usually focus a single purpose: Tip calculator, loan calculator, Mortgage Calculator, body mass index calculator, unit converter. The list goes on. Who needs these calculators? In reality, there are always people who need these opportunities.

In essence, a biweekly mortgage allows pay one extra payment a year thus saving you thousands of dollars in interest and paying off your mortgage early. Let's examine this injury is a little farther.

When wind up get trainees loan, they cannot shop around and compare. You do not have to choose the lender your school normally uses; you can use any lender you wish. This is when you will in order to shop around and discover what loans you are offered. Should already have a lender you presently deal with, you might be able to use them for an education loan also.

For example, a $100,000 mortgage by using a 12% Mortgage Calculator Toronro price of interest will have an annual $12,000 interest advance. The monthly payment will be $1,000 (1/12 on the annual price of interest payment).

Let us consider how the original price of interest is 9.5% for a 30-year loan of $250,000. For people who have 120 months or a few years left of the particular loan along with the interest rate reduces to 6.25%. You can go to have a refinance loan of $200,000, of 20 years at five.25%. Using a mortgage calculator for all the the amount you want of $139,623.21, your monthly payment works to be able to $1580.17 for the old loan and $1231.43 for the actual refinance loan, giving you monthly savings of $348.74. This determines to a saving of $125544.84 nearly the refinancing home loan. All figures are indicative and probably will not reflect actual interest cost. For the current interest rates, you can use the mortgage calculator for refinancing the loan which is available at most financial online websites.

This tool is user friendly too. To produce to provide you with all of the points you need to make a good decision in regards home loan you are taking in. Compare several different home loan lenders to see what they are able to offer as well as to see just exactly what the difference in dollars and cents is truly. Taking just a few minutes to softly consider these options, by using a mortgage calculator can aid you to benefit often times over from home loan.